When precious metal investors buy a one ounce silver bar, they are making a strategic financial decision. Adding a silver bar collection to one’s investment portfolio is a great way to diversify and hedge market volatility. According to Bank Rate, 10 percent of an investment portfolio should be made up of gold and silver. At Sigo Co, it is our goal is to make your portfolio as strong as possible, so give us a call today.

The Three Main Reasons for Investing in Silver One Ounce Bars

Investors buy silver bars and other forms of precious metals for three simple reasons:

- As an investment

- A 1 ounce silver bar is a savvy inflation hedge

- For bartering and survivalist purposes

People who invest in silver 1 ounce bars look for price increases based off of the supply and demand basics of silver. For example, Warren Buffet is probably the most famous silver investor of all time. In 1998, he bought 129.7 million ounces of silver for his company, Berkshire Hathaway. It is not exactly clear if it was primarily for investing or as an inflation hedge because he never disclosed what he allocated his silver for when he purchased it and never did after selling it off, either. One thing is for certain though – Warren Buffet didn’t purchase that amount of silver only to later dispose of it for bartering or survivalist reasons.

Where To Purchase 1 Ounce Silver Bars for Sale

Silver is widely available to purchase in many forms from various places, such as auction sites like eBay, precious metal market exchanges or private sellers looking for a return on their own investments. Finding one ounce silver bars for sale takes some research and education though. Sigo Co can help. Our support specialists have years of experience in precious metals, and will arm you with the information you need to make an informed decision.

What to Look for in Silver Investments

Potential silver bar consumers should know what to look for before making any financial transaction. It is important to find the best purity, the highest ease of liquidity, and the most trustworthy dealer possible. There are issues of financial privacy involved in investment grade purchases, too. However, if you are knowledgeable and prepared, you will be well equipped to work with silver dealers and make the right decisions to maximize the value of your purchase.

Bullion Bars: The Preferred Form of Silver

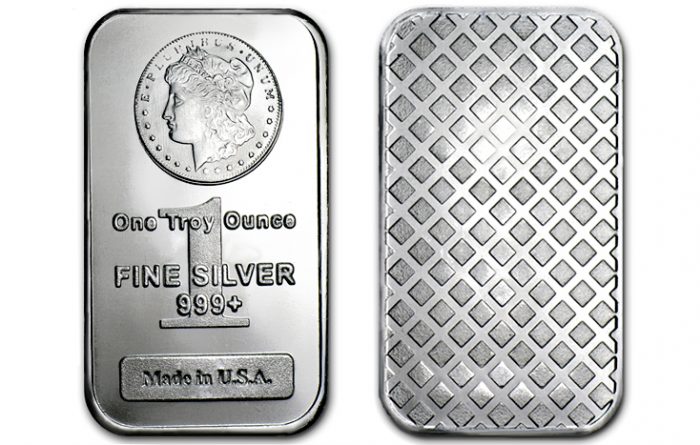

One ounce bullion bars are the most commonly traded, and they are considered investment-grade fine silver. That is the main reason for investing in bullion bars – their high level of purity. Silver bullion comes in other forms besides bars, but they all have equal value if measured by weight because they contain the same amount of silver. Bullion ingots and bars are often preferred in the same weight increments like one, five or even 100 ounce bars because they stack easier.

One ounce silver bars come in different forms on the market the same ways coins do. Depending on the brand that makes them, the designs may vary. Many times, it often comes down to aesthetic appeal. Here at Sigo Co, we have silver that matches all tastes and preferences.

Summarizing the Information

If you want to purchase silver as an investment, inflation hedge or for bartering in the event of a national collapse, you do not need to be a full-time investor or an expert on precious metals and commodities. However, you still need to do your research. But don’t fret – there is plenty of information on the topic available to anyone seeking it. Just remember, if you waste too much time waiting on making a purchase, you might miss an upward trend in the market, which translates into a lost opportunity. Start investing in silver today to maximize the value of your portfolio and stabilize your financial future.